Trust/Foundation Hybrid Structure – An Asset Protection Structure for Internationally Mobile Individuals

Asset protection and wealth preservation continues to be a primary focus for high net worth individuals.

However, the ever increasing international mobility of individuals and their families means that the traditional Common Law jurisdiction solution of a Trust, or Civil Law jurisdiction solution of a Foundation may not, in isolation, prove to be optimum solutions for an individual’s needs as they find themselves moving between Common and Civil Law jurisdictions.

For example, a Non Domiciled individual currently resident in a Common Law jurisdiction, such as the UK, could benefit from the creation of an offshore Trust structure to hold their non UK situs assets because Trusts are recognised under Common Law and their tax treatment is clearly defined. However, should the individual subsequently relocate to a Civil Law jurisdiction which does not recognise Trusts, the asset protection afforded could be considerably eroded.

Conversely an individual currently resident in a Civil Law jurisdiction could reasonably be advised that the creation of a Foundation would be a useful planning tool. However, should the individual find that their professional or family commitments bring them to a Common Law jurisdiction, let us use the UK again as our example, they could find that the tax treatment of a Foundation is not as beneficial or certain as that of a Trust.

A Possible Solution

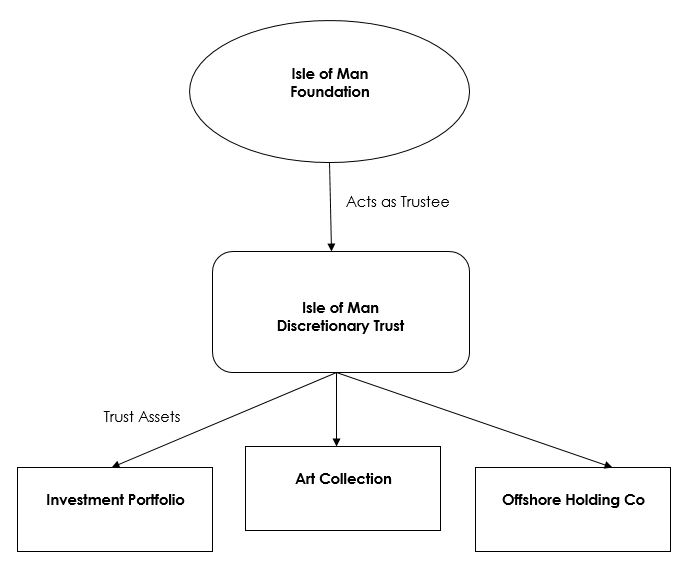

Individual circumstance will need to be reviewed, however, one possible solution to the above scenario is the creation of a Trust-Foundation hybrid, whereby an Isle of Man Foundation is created with the sole purpose of acting as Trustee of an Isle of Man Trust.

The Trust is settled in the usual way with all assets being under the legal but not beneficial ownership of the Foundation as Trustee. The Foundation is obliged to handle the Trust assets in accordance with the provisions of the Trust instrument and has a fiduciary duty to the Trust Beneficiaries.

As such, from a Common Law perspective this is a recognisable Trust structure with clearly defined treatment.

However, should the structure be challenged within a Civil Law jurisdiction where the concept of a Trust is not readily accepted, and creditors “look through” the Trust to the legal owner of the assets, the courts would recognise the legal status of the Foundation, thus preserving the asset protection.

Basic Structure chart

A very simple example of such a structure would be:

Additional Information

If you require any further information regarding the above article, please speak to your usual Dixcart contact or to Paul Harvey at the Dixcart office in the Isle of Man: paul.harvey@dixcart.com.

Dixcart Management (IOM) Limited is Licensed by the Isle of Man Financial Services Authority