Switzerland is a friendly place to start a business, with many international companies having their headquarters in the country. Companies both large and small are attracted to Switzerland for its stability, the strength of its currency and some of the lowest corporation taxes in Europe.

So you have decided to start a business in Switzerland? You have a business plan and are ready to get started.

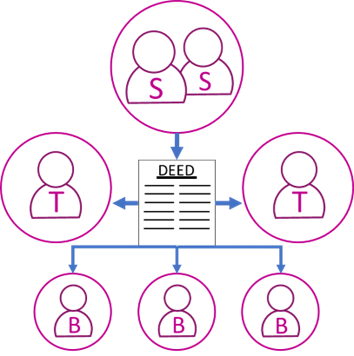

Legal Structure

Entrepreneurs can choose from several legal structures when setting up a business in Switzerland, including:

- Sole Proprietor: A business structure where a single individual owns and operates the business, assuming full personal liability for its obligations.

- Partnership: A legal form where two or more individuals share ownership and responsibility for a business, with options for general and limited partnerships.

- Limited Liability Company: A legal business entity that combines elements of partnership and corporation, providing limited liability to its owners while maintaining operational flexibility.

- Branch: A business extension of a foreign company in Switzerland, operating as a dependant part of the parent company and subject to Swiss regulations.

Each structure has its advantages and implications for liability, taxation and governance, so it is crucial to select the most suitable option based on the nature and scale of the business.

Registration Process

The registration process varies depending on the chosen legal structure. However, in general, the following steps are involved:

- Choose a business name and verify its availability.

- Open a bank account with a Swiss bank to deposit the share capital.

- Prepare the necessary documentation.

- Founders Meeting with a Public Notary.

- Register the business with the relevant commercial register and tax authorities.

- Obtain any required permits or licenses based on the industry and activities of the business.

Once you have chosen your Legal Structure and started the registration process, important next steps are to understand your accounting requirements and tax considerations.

Accounting and Reporting Requirements

Swiss companies are required to maintain and file accurate accounting records in accordance with established financial standards ensuring compliance with the regulatory requirements.

Tax Considerations

Switzerland offers a competitive tax environment for businesses, with varying rates between cantons. Key aspects of taxation include:

- Corporate tax: businesses are subject to federal, cantonal, and municipal taxes and it is essential to understand the tax implications based on the location and nature of the business activities.

- Value Added Tax (VAT): Businesses with annual turnover exceeding CHF 100,000 or more a year must register for VAT and charge VAT on their goods and services. Value-added tax is a general tax levied on the distribution, import, export and sale of a product or service by any company in Switzerland.

- Double Taxation Treaties: Switzerland has double taxation treaties with numerous countries to avoid double taxation of income in multiple jurisdictions.

Employment Regulations

Switzerland’s employment laws are characterised by flexibility and employee protection. These considerations include:

- Employment Contracts: Written contracts outlining terms of employment, including wages, working hours and benefits are standard practice.

- Work Permits: Foreign nationals working in Switzerland may require work permits, which are subject to specific conditions depending on the individual’s nationality and qualifications.

- Minimum Wages: While Switzerland does not have a statutory minimum wage at the federal level, certain cantons and industries may have minimum wage regulations.

Compliance and Regulatory Matters

Switzerland has a well-established regulatory framework governing various aspects of the business operations, covering:

- Company Law: Compliance with Swiss company law, including corporate governance, shareholder rights and disclosure obligations.

- Anti-Money Laundering Regulations: Implementation of AML compliance programmes to combat money laundering and terrorist obligations.

- Data Protection: Adherence to data protection regulations, ensuring privacy and security of personal data.

- Regulatory Authorities: Oversight by regulatory bodies specific to industries or activities, such as FINMA for financial institutions.

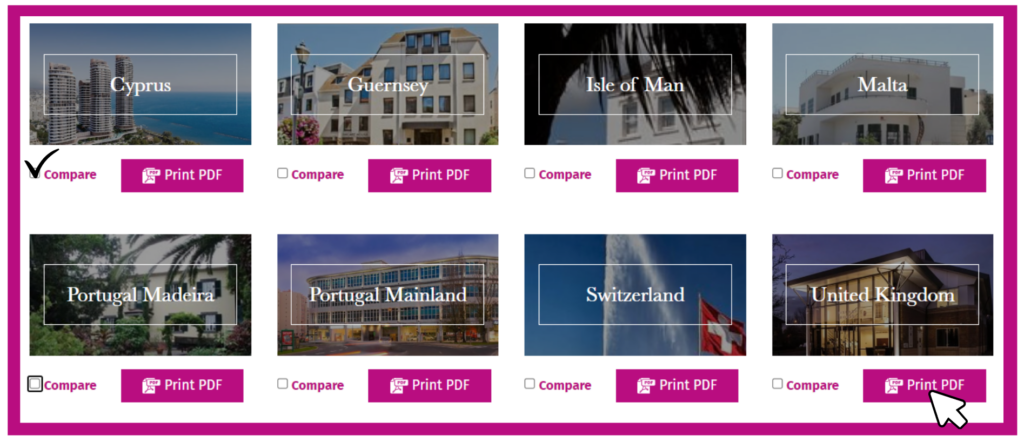

Advice and Additional Information

Dixcart has had an office in Switzerland for over twenty-five years and is well placed to provide advice regarding the establishment of companies here. Please contact Christine Breitler at the Dixcart office in Switzerland: advice.switzerland@dixcart.com.