2024 offers a spectrum of business opportunities for the world ahead and Madeira offers great potential – even more so for a small archipelago island in the Atlantic Ocean.

Putting Madeira on the map for ambitious entrepreneurs has never been as exciting as now – as the world moves to an environment where substance is of importance coupled with a minimum global tax rate, Madeira stands out as a winner.

Why does Madeira Benefit from a 5% Tax Rate Compared to the Rest of the World?

Madeira has been able to benefit from a taxation rate of 5%, with the approval of the European Commission, and is included in the OECD whitelist, as the purpose is to provide for the development and diversification of this small island economy. The International Centre of Madeira (IBC of Madeira), the jurisdiction which regulates Madeiran companies, has been formally approved by the European Commission as a State Aid Regime and thus is allowed to benefit from the low tax rate.

The 5% is particularly attractive since the rate is applicable until the end of the year 2028.

What sort of Companies Can Operate in MIBC in 2024?

2024 is adjusting quickly to new realities, with the tide turned against the pandemic, new themes and trends are quickly arising, providing new possibilities for business opportunities. We provide below some examples of business ventures that may be undertaken in the island of Madeira, through the IBC:

- Technology

Unlimited potential lies with the sort of companies that may be created in the technology space through the IBC of Madeira. Selling hardware and software products to international markets is of great interest.

Granular examples of these include; technology for the tracking of overseas shipments, cybersecurity products and/or services, technology for direct air capture which may be sold after development, the selling of 3D printed bone implants, selling of virtual influences, among other possibilities, plus the endless possibilities of housing services in an IBC for the metaverse.

In terms of future technology, the Madeiran IBC may be used; by companies developing drones that will be used to monitor crops or perform delivery of foods, medicines, books and other items. It is worth pointing out that Madeira has a Technology college with young graduates which makes it convenient to employ a local workforce. This may be more cost effective for start-up operations sensitive to prices, due to the low costs of living in Madeira.

- Trademarks

The underlying potential of earning income from a trademark is never ending and varies widely – whether it is a word, phrase, symbol, design or a combination of things that identifies your brand, trademarks are a great way to earn income in a tax efficient way in the IBC of Madeira.

Companies may set up group structures whereby the operational and trading activities occur in the respective jurisdictions and these companies make a payment to the Madeiran company who owns the trademark. The income from the use of the trademark is then subject to the beneficial tax rate of 5%.

- Telecoms

With a young population of educated Madeiran locals, setting up a call centre in the tropical island may be of interest. International companies, hotel, insurance or bank groups, among others, who require call centres, may set up their operations in the island and benefit from the lower tax rate for the income earned by the company for telecoms communication.

What makes this option very attractive is the fact that there are many young people in Madeira who are highly educated and able to speak more than two languages – English being one of them! Further to this, and as mentioned already, Madeira has a low basic salary (one of the lowest in Europe) – making it a feasible financial option for businesses. Lastly, Madeira shares the same time zone as London, one of the world’s most important financial districts – and it is therefore easier, from an operational point of view, to do business with the same time zone.

- Media

Companies are rushing to win back customers post the pandemic. As more ads become digital, the benefit of having a Madeira IBC company to sell such digital advertisements may be very favourable. Other examples of companies that may be created in the IBC to earn income include; digital installations to generate data that may help companies hone their marketing, generating mobile ads and earning royalty income from photographs taken.

- Entertainment

More drama is expected in the entertainment industry in 2024, as films are being released simultaneously on streaming services and cinemas – viewers are looking for entertainment post the pandemic. Creating production in Madeira is a great way of making use of the island’s natural beauty, not even mentioning the stunning ‘levadas’ – whether you are a TikTok influencer earning income from advertising roles or a producer wishing to provide services from Madeira or creating content in Madeira, the 5% income tax regime may be deemed highly beneficial.

As the gaming industry continues to experience tailwind, with talk around the Metaverse becoming more and more of interest, netizens can work, shop and play. The creation and sale of gaming products through the right to explore may be done through an IBC company of Madeira, and may be of particular interest with a high number of qualified graduates from the Madeira Technology University.

- Retail

Trading is one of the most popular options for a Madeira IBC. Typical structures include the exporting of goods from one place and importing to the next place, with the trading operations occurring in an IBC of Madeira. With online businesses on the rise, this form of trading is proving to be more and more popular.

- Food and Farming

As the world expands rapidly with a growing population and a shortage of food, the Madeira IBC may be used to recycle food. It is known that millions of tonnes of food is wasted a year. Start-ups are racing to rectify this issue by creating upcycled food by using bits of food that fall through the cracks of the food system in order to create something new. Using a Madeira company to sell such systems may be of particular interest and may be seen as a gateway into the European market to achieve this objective.

What Substance is Required to Incorporate an IBC company in Madeira?

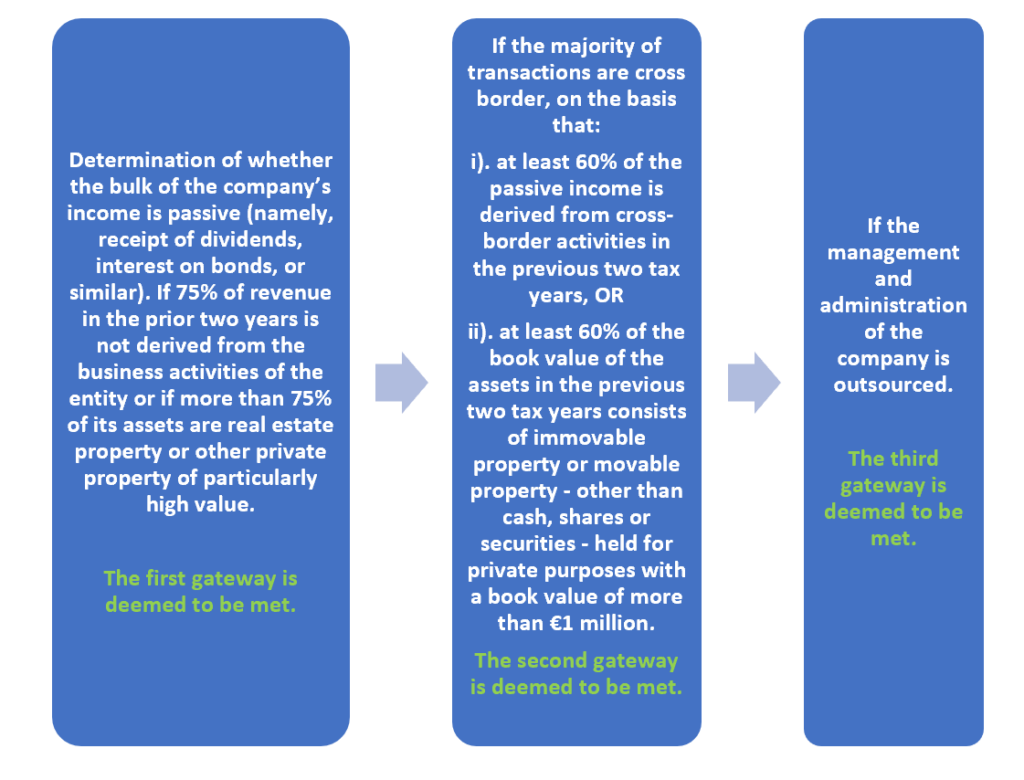

Please refer to the article: Three Types of Portuguese Company Advantages and Criteria for more details of the related substance criteria to establish a company in the island of Madeira.

How May Dixcart Help?

Operating in Madeira since the late 1980s, Dixcart was one of the first company service providers on the island, to assist businesses to establish within the IBC. We continue to have an office in Madeira and have subsequently also opened an office on the Portuguese mainland, in Lisbon.

Please reach out to our specialists to find out more should you have any questions: advice.portugal@dixcart.com

Note the above is not considered tax advice and is purely for marketing purposes to understand the possibilities of using an MIBC structure and that the facts and circumstances need to be evaluated by an appropriate professional with the necessary skill and competence prior to implementing such structure.