Further to the previous article regarding the basics of Guernsey Trust Structuring (please see: Understanding Guernsey Trust Structures: A Guide by Dixcart Guernsey) we look to explore the practical uses of Trusts and detail case studies where Trusts are used as an effective tool for Estate and Succession Planning, and Asset Protection.

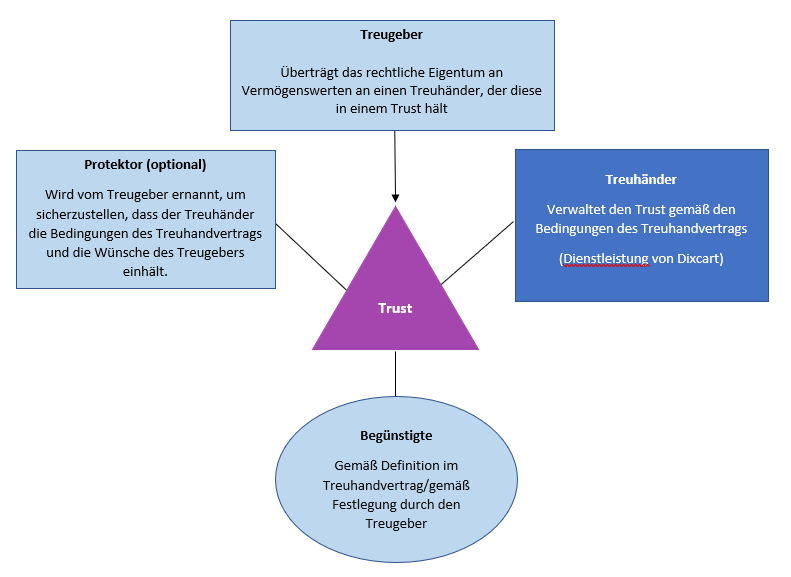

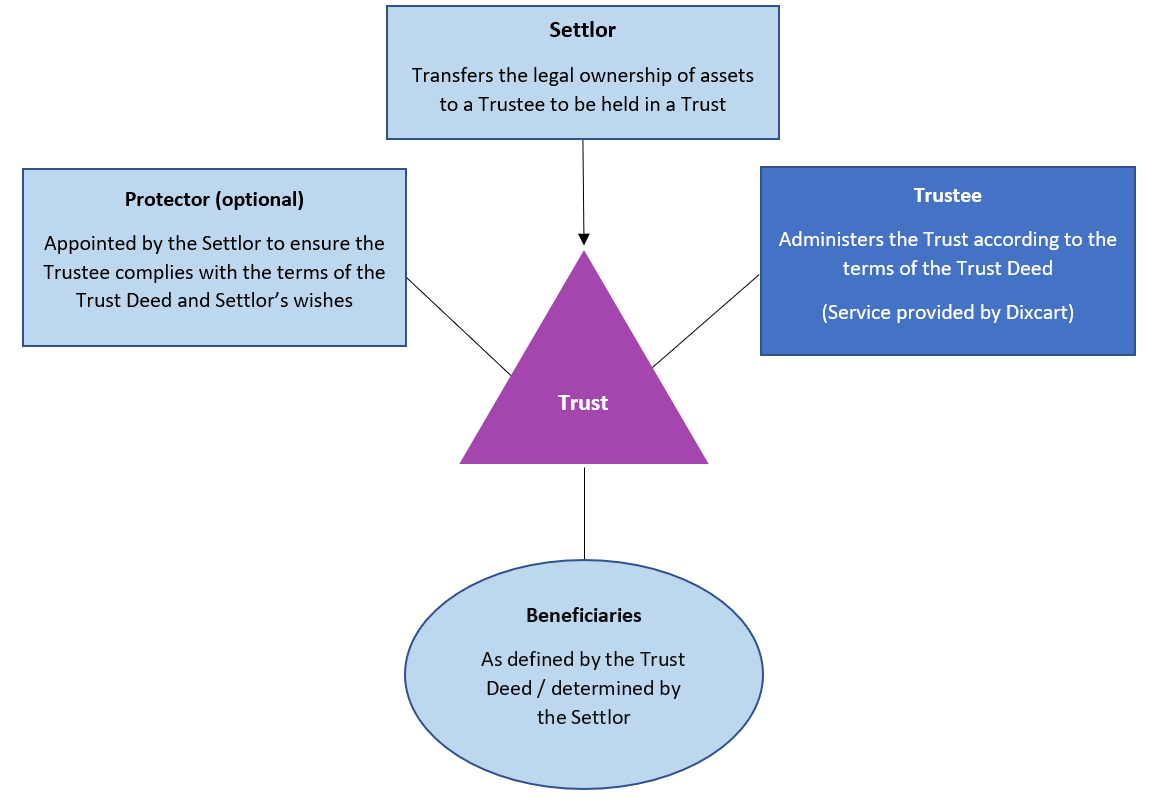

A Trust creates a division of ownership between the Trustee, who is the legal owner of the assets comprising the Trust Fund, and the Beneficiaries, who are the equitable owners. The Trustee is bound by a number of Fiduciary and Statutory duties to, at all times, act in the best interests of the Beneficiaries as a whole, whilst adhering to the terms of the Trust Deed. In the meantime, they must also protect, preserve and enhance the Trust Fund.

Trust Creation

When setting up a Trust, there are three certainties which must be fulfilled to validate and establish the Trust. These are:

- The certainty of intention: a clear intention that the Settlor intends to create a Trust by transferring legal ownership of the Trust Property to a Trustee to hold for the benefit of defined Beneficiaries. This is evidenced by an executed Trust Deed and supported by clear communication between the Settlor / their advisor(s) and the Trustee, discussing the goals and intentions the Settlor has for the Trust, prior to establishment.

- The certainty of subject matter: clearly defined Trust Property, the initial settled funds are usually a nominal amount of £1, £10 or £100 and this is indicated within the Trust Deed, with further assets to be added at a later date.

- The certainty of objects: clearly defined Beneficiaries or a Beneficial Class who will benefit from the Trust, which can include the Settlor.

Other considerations that the Settlor should make at the outset include; whether there are any contingencies to the Beneficiaries benefitting, and whether a Protector will be appointed to provide some oversight to the structure and to select a trusted and experienced Trustee to administer the Trust on behalf of the Beneficiaries.

Whilst the Settlor has given up legal ownership of the assets, the Settlor can request the Trustee to undertake certain actions and to determine guidelines and conditions as to how and when the Beneficiaries are to benefit from the Trust, however these should be expressed as the Settlor’s wish and are not legally binding. This protects the validity of the structure and supports the certainty of intention that the Settlor does intend to hand over the ‘reins’ to the Trustee. For a Discretionary Trust, the Trustee would make the ultimate decision as to whether a Beneficiary should benefit from the Trust, paying close attention to their fiduciary duty to consider the interests of all Beneficiaries, before making any distribution of Trust assets.

Whilst a Settlor can reserve some powers, such as to retain investment powers over the Trust assets (which is the most commonly used reserved power), by reserving too many powers, the Trust could be set aside as a sham, in contravention of the first certainty of intention.

We shall explore some case studies as to why a Trust might be settled in the first place and the benefits of doing so.

Case Study 1: The Spendthrift Beneficiary

There may be a family member who struggles to spend within their means, has faced trouble with addiction or perhaps has not had access to previous wealth and, on inheriting a lump sum, would risk quickly eroding their inheritance without saving for future events.

A Trust structure could protect this Beneficiary and the Trust Assets from depletion and provide continued support to the Beneficiary over their lifetime, without quickly diminishing the corpus of the Trust Fund.

Some examples as to how the Trust could assist would be by paying the Beneficiary’s medical and educational bills directly, purchasing a home for the Beneficiary to reside in, or by assisting with the financial support of the Beneficiary’s own child.

There could also be a contingent Beneficiary specified within the Trust Deed, that their benefit is contingent on a certain event such as them attaining the age of 25, or upon their marriage. This provides flexibility regarding future needs and/or potential contingencies.

Case Study 2: Tax Planning and Passing Assets to the next Generation

Whilst independent tax advice should be taken by all clients, the utilisation of a Trust could be an effective tax planning tool and centralise the ownership of worldwide assets, legally owned by the Trustee.

For example, there would be no inheritance tax payable on the assets held within the Trust upon the Settlor’s demise. Although Beneficiaries should seek tax advice before receiving a distribution from a Trust.

Case Study 3: Preservation of Wealth and Selected Distribution of Assets

This leads us nicely onto the preservation of Family Wealth and Estate Planning.

By settling a Trust, this would ensure an orderly succession of assets after the Settlor’s death, the retention of property within the family, and the continuity of ownership of a family business after the Settlor’s death.

The Trust would also establish a clear and unchallengeable basis for distribution of assets after the Settlor’s death and protects family property from dissipation.

By securing the services of an independent, expert person to manage and control the assets (the Trustee), capital can be preserved for the next generation and property can be held for minors or other dependants.

Case Study 4: Forced Heirship

In some jurisdictions the local law requires assets held in a person’s estate to pass to specified heirs in stated proportions. By settling a Guernsey Trust, the assets would be distributed in line with the provisions of the Trust Deed.

Case Study 5: Confidentiality

A common priority of a high-net-worth individual looking to establish a Trust is confidentiality. By transferring legal ownership of assets to a Trustee to hold within a Trust, this aids the Settlor in keeping their assets confidential.

There is no Beneficial Ownership Register in Guernsey, unlike a number of other offshore jurisdictions and Trusts are not registered in Guernsey.

Case Study 6: Asset Protection

A client may seek the protection of a stable, political and social environment for the ownership and management of their assets or be looking for a safe jurisdiction to maintain their assets, if relocating or working abroad.

They may also be seeking to protect the Trust Property from future litigants who would come to the court in the hope of setting the trust aside in order to access the Trust Fund. An attempt to attack a Trust structure could come from an array of complainants such as a disgruntled Beneficiary, a divorcing spouse, or a future creditor.

By ensuring that; the goals and intentions of the Trust are discussed with the Trustee at the outset, the three certainties are clearly in place and that the Deed is properly drafted upon setup, this will provide the Trust with a high level of protection against any potential attack.

Case Study 7: The Charitable Trust

Finally, a philanthropically minded individual might look to set up a Charitable Trust with a specific charitable purpose. This could include providing for, the relief of poverty, the advancement of education, the advancement of religion, the advancement of arts, culture, heritage, or science and the advancement of animal rights, amongst others.

If the charitable purpose specified by the Settlor at the outset cannot be carried out for any reason, the law provides that the court can order that the property can be applied to another charitable purpose similar to that originally intended.

Summary

In summary, there are many modern uses for offshore Trust structures, and these continue to develop.

An emerging trend is the addition of cryptocurrency assets to a Trust structure, although it is worth noting that considerable due diligence is required when accepting these types of assets into a Trust, and it is recommended that a specific clause be added to the Trust Deed to allow the investment of the Trust Property into such volatile, high-risk assets.

Should you require any further information or wish to discuss your requirements, please contact Beth Le Cheminant at advice.guernsey@dixcart.com.