Background

Switzerland is an incredibly attractive jurisdiction for international companies and high net worth individuals, seeking economic and political stability.

Reasons Why Switzerland is a Favoured Location

- Political, financial, social and economic stability

The economy of Switzerland is one of the world’s most advanced economies. The service sector plays a significant economic role, particularly the financial services sector. The economy of Switzerland ranks first in the world in the 2019 Global Innovation Index, and fifth in the 2019 Global Competitiveness Report.

The economy of modern Switzerland is recognised as one of the world’s most stable. In addition, in terms of the ‘human development index’, a statistical composite of life expectancy, education and per capita income, Switzerland ranked second in the world in 2018, with a rating of 0.944

In terms of foreign policy, the country has a long-standing tradition of neutrality, and has been a constitutional democracy since 1848.

The stable political and economic environment of Switzerland makes it an appealing jurisdiction from an asset protection perspective, with the added benefit of attractive tax regimes for both companies and individuals. These factors, combined with the country’s high regard for personal privacy and confidentiality, attract families and businesses from all over the world.

2. A favourable tax environment for companies and foreign investors

Switzerland has long been known as a popular location for international trading companies. Due to its business-friendly environment, it has been home to all types of companies, from the headquarters of multinationals to small offices, with one employee.

Switzerland’s attractiveness to foreign investors, will be further enhanced in January 2020, with implementation of the Swiss tax reforms approved by Swiss voters. Active operational companies will be taxed at between 12% and 14%, which can be reduced to as low as 9% with the application of instruments such as patent box.

Holding companies benefit from a ‘participations value deduction,’ when certain conditions are met. This means that they do not need to pay corporate tax on dividends received from participations and on capital gains.

Dividend distributions from subsidiaries to shareholders based in an EU jurisdiction or in Switzerland, are not taxed. In situations where the shareholders are not located in the EU or in Switzerland, but in a country with which Switzerland has a tax treaty, the withholding tax is generally between 0% and 5%.

3. Banking advantages

Switzerland is the premier financial destination for international investment and private asset protection. It also offers one of the strongest and most commercial banking centers in the world.

It has a long history and expertise dealing with international currencies and open capital markets. Many banks have dedicated desks for particular jurisdictions, providing specific services to clients.

The main benefits of having a Swiss bank account are the low levels of financial risk and high levels of privacy

There is a wide variety of large domestic and overseas banks, experienced in operating accounts for different industries; trading, commodities, commercial, and also for private individuals.

Switzerland is well-known for its private banks, an exclusive niche for high net worth individuals, which provide sophisticated personal financial services and products to an exclusive clientele.

- Different types of Swiss corporate structures

As in many countries, Switzerland offers a number of different company structures, these include; Public Limited Companies (SA/AG), Limited Liability Companies (Sarl/GmbH) and branches of foreign companies. Less common than in other jurisdictions are Swiss ‘Associations’:

Association (Verein)

The Swiss Association is a legal entity which can undertake commercial activities. Formation is simple and does not require share capital. Members do not share liability for the debts or actions of other members. The identity of members and directors is not public. It is an ideal structure for a business organisation made up of a number of independent offices. This type of structure is often used by multinational professional firms and enables them to operate globally under one branch, whilst maintaining separate profit pools and ringfencing liabilities in each of the countries in which they operate.

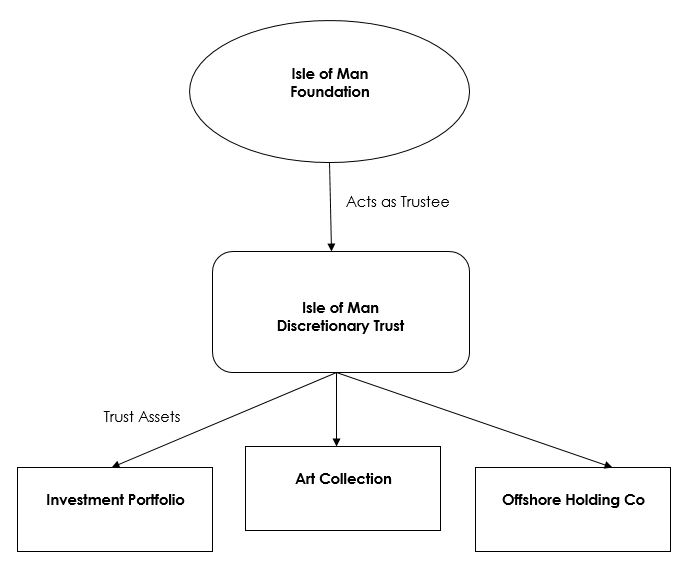

- Trusts and Private Trust Companies as asset protection vehicles

Widely used in Anglo-Saxon countries, a trust is flexible and, in the right circumstances, can be an effective asset protection vehicle. It provides anonymity for families, and confidentiality regarding the assets and/or companies held within it. Trusts can be a useful aid in terms of succession planning, and can assist with long term inheritance matters.

A Private Trust Company (PTC) is a corporate entity authorised to act as trustee. The client and his/her family can actively participate in the management of the assets and decision-making processes, as well as sitting on the board of the PTC.

Switzerland recognised trusts with the ratification of The Hague Convention on the Law Applicable to Trusts (1985), on 1 July 2007. Whilst there is no domestic law governing trusts in Switzerland, trusts from other jurisdictions, and their specific rules, are recognised and can be administered in Switzerland.

In Switzerland the settlor (the individual who settles assets into the trust for the benefit of the beneficiaries) can choose the law of any specified trust jurisdiction to govern the trust. For example a Guernsey trust can be established with a Swiss Trustee.

The tax advantages available in using a trust with a Swiss Trustee essentially depend on the tax residence of the settlor and the beneficiaries. Professional advice should be taken.

The Dixcart office in Switzerland is a member of the Swiss Association of Trust Companies (SATC) and is registered with the Association Romande des Intermediaires Financiers in Switzerland (ARIF).

Additional Information

If you would like additional information regarding the use of Switzerland for asset protection, please contact Christine Breitler at the Dixcart office in Switzerland: advice.switzerland@dixcart.com. Alternatively please speak to your usual Dixcart contact.