A Report – Recognising The Dynamic Growth of The Malta Financial Services Sector

The Malta Financial Services Authority (MFSA) has published its Annual Report and Financial Statement for the year 2018. It presents an overview of the activities and work carried out by the MFSA, together with details about the industry’s performance and explains the Authority’s vision for the coming years.

Despite a challenging and highly competitive environment, in 2018, the Maltese financial services sector continued to register significant growth rates, with a growth of 9.5% over the previous year.

Financial Services in Numbers

The MFSA registered an additional 144 new entities, as an increased number of businesses decided to make Malta their jurisdiction of choice, bringing the number of entities licensed by the MFSA up to over 2,300.

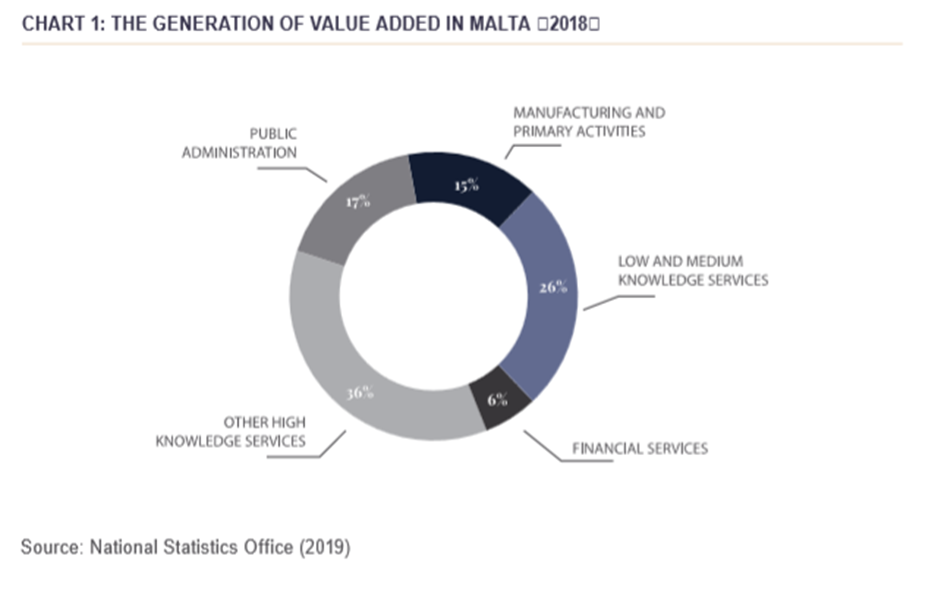

The financial services industry in Malta is a key pillar of the Maltese economy, contributing around 6% of Gross Value Added (GVA) in 2018, as shown in Chart 1.

At the end of 2018, the sector employed more than 12,000 people, 1,000 of which were new jobs created during that year. This brings the share of local employment within the financial services sector to 5.3%, almost double that recorded as the average for other member states of the European Union, which stands at 2.9%.

Deposits within domestic banks grew by 6.1%. These were mainly concentrated in current account deposits, with the share of such deposits amounting to around 70.3%. The amount of bank loans and advances grew for domestic banks: 6.3% for core and 18.0% for non-core.

The total assets of the securities and investment services sector in Malta grew by 8.3%, amounting to €11.7 billion in 2018. Corporate bond trading reached €93.7 million in 2018, up 22.5% from 2017.

The aggregate net asset value of Funds Domiciled in Malta totalled €11.7 billion, up 8% from 2017 and the locally managed assets of non-Malta domiciled funds grew by 9.1%, to €24 billion.

MFSA Vision for the Future

During 2018 MFSA published over 600 regulatory notifications to guide regulated entities and to safeguard the consumers of financial services.

The Virtual Financial Assets (VFA) Act came into force in November 2018, making Malta a pioneer in the world of distributed ledger technologies and digital asset legislation.

The MFSA also signed a Memorandum of Understanding (MoU) with the Maltese Financial Intelligence Analysis Unit (FIAU) to enhance collaboration and improve the thoroughness of ‘Anti-money Laundering’ and ‘Customer Facing Staff’ on-site reviews and inspections.

Additional Information

If you would like further information on this subject, please contact the Dixcart office in Malta: advice.malta@dixcart.com or your usual Dixcart contact.